Child tax credit expansion part of bipartisan $78B deal proposed in Congress

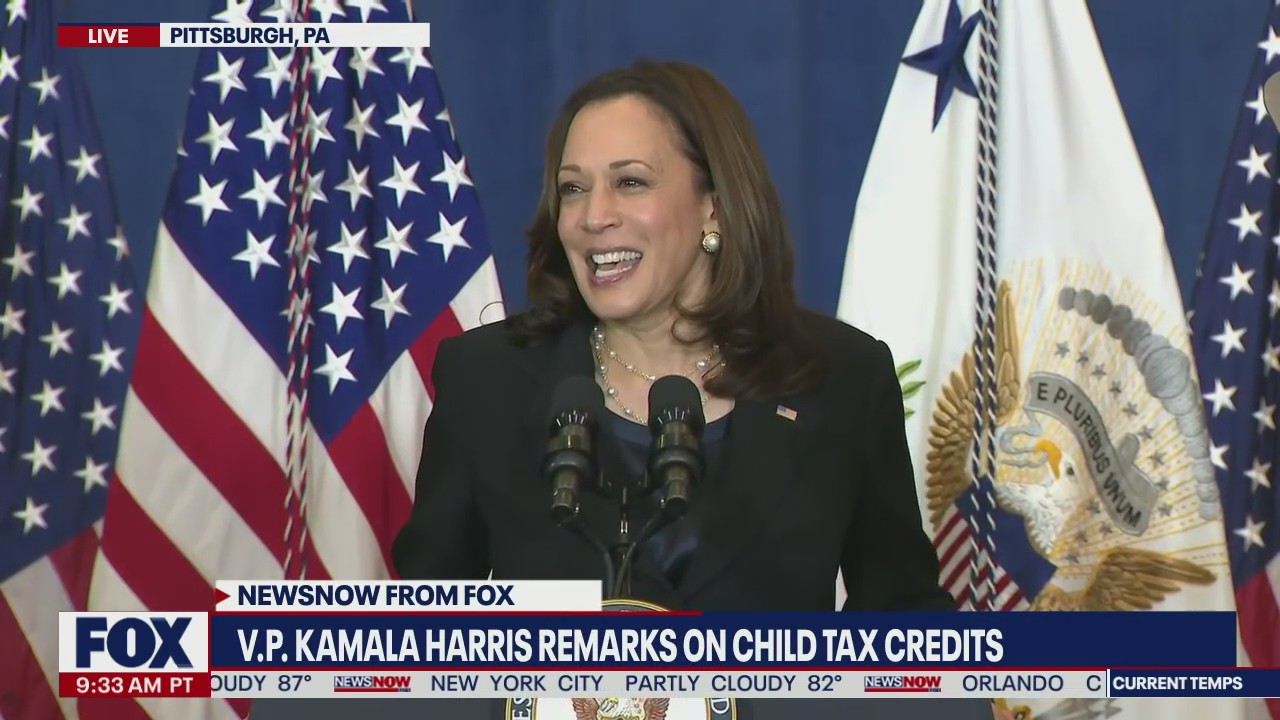

Kamala Harris gives remarks on Child Tax Credit expansion

Vice President Kamala Harris spoke in Pittsburgh on Child Tax Credit Awareness Day on June 21, 2021, a day intended to make Americans know about the monthly payments starting July 15.

WASHINGTON - In a bipartisan move, senior Congress lawmakers announced a deal that would expand child tax credits as well as tax breaks for business.

The $78 billion package will increase the refundable portion of the child tax credit for 2023, 2024, and 2025. It would also eliminate penalties for larger families. Taxpayers could also use either current- or prior-year income to calculate the child tax credit in 2024 or 2025.

"Fifteen million kids from low-income families will be better off as a result of this plan, and given today’s miserable political climate, it’s a big deal to have this opportunity to pass pro-family policy that helps so many kids get ahead," Senate Finance Committee Chairman Ron Wyden (D-Ore.) said in a statement.

RELATED: Analysis: Who voted for Trump in Iowa – and who didn't

"My goal remains to get this passed in time for families and businesses to benefit in this upcoming tax filing season, and I’m going to pull out all the stops to get that done," he continued.

WASHINGTON, DC - DECEMBER 07: Senator Sherrod Brown (D-OH), Senator Cory Booker (D-NJ) and Representative Suzan DelBene (D-WA-01) with supporters during Press Briefing With U.S. House And Senate Champions, Impacted Families on Expanding the Child Tax

"American families will benefit from this bipartisan agreement that provides greater tax relief, strengthens Main Street businesses, boosts our competitiveness with China, and creates jobs," Ways and Means Chairman Jason Smith (MO-08) added.

Businesses could also get some financial relief by being able to deduct the cost of their U.S.-based R&D investments instead of over five years. Congressional leaders also want to expand the expense cap for small businesses. They can write off up to $1.29 million, an increase above the $1 million cap enacted in 2017.

The package must still be approved by both the full House and Senate before going to President Joe Biden for a signature.

The proposal comes at a time as the country deals with inflation.

RELATED: In his closing pitch to Iowa Republicans, Trump says their votes can help him punish his enemies

Higher energy and housing prices boosted overall U.S. inflation in December, a sign that the Federal Reserve’s drive to slow inflation to its 2% target will likely remain a bumpy one.

U.S. inflation edges up

Higher energy and housing prices boosted overall U.S. inflation in December. LiveNOW from FOX's Jeanè Franseen speaks with Mike Walden, an Extension Economist at North Carolina State University about the latest U.S. inflation report.

Thursday’s report from the Labor Department showed that overall prices rose 0.3% from November and 3.4% from 12 months earlier. Those gains exceeded the previous 0.1% monthly rise and the 3.1% annual inflation in November and were slightly above economists’ forecasts.

The Federal Reserve Bank of New York reported this week, for example, that consumers now expect inflation to come in at just 3% over the next year, the lowest one-year forecast since January 2021. That’s important because consumer expectations are themselves considered a telltale sign of future inflation: When Americans fear that prices will keep accelerating, they will typically rush to buy things sooner rather than later. That surge of spending tends to fuel more inflation.

The Associated Press contributed to this report. This story was reported from Los Angeles.